The recent resurgence of violence in Lebanon dashes hopes that the worst of the crises that have afflicted the West Asian country over the past four years have been overcome. Modest indications of economic recovery from one of the “most severe crisis episodes (seen) globally since the mid-19th century” were forecast for 2024, following a spiral of hyperinflation, debt default, and collapsing public services. But as Lebanon runs the risk of being drawn into a conflict with Israel, this glimmer of hope has dimmed.

More than half of travel reservations to Lebanon were cancelled during the winter holidays due to the Gaza conflict. The abrupt drop in tourism-related spending will swiftly undo the sluggish economic growth predicted for 2024. Any further internal population displacement brought on by the conflict would strain state services to the limit.

A recurrence of the 2006 Lebanon War would exacerbate Lebanon’s already precarious economic situation and result in a humanitarian catastrophe. Notably, neighbouring Mediterranean states are aware that a new conflict would likely prompt thousands of Lebanese citizens to leave their country, contributing to an already established trend of outward migration.

Prelude to War?

The militant Lebanese group Hezbollah, backed by Iran, regards itself as an opponent of Israel. There are an estimated 130,000 rockets and missiles in Hezbollah’s arsenal, ready for any confrontation with Israel. Hassan Nasrallah, the secretary general of the organisation, was cautious in his speech despite this hostile posture. Is he trying to prevent an all-out war against Israel? Maybe.

Nasrallah spoke about the possibility of using negotiations to “liberate” all of Lebanese territory and to stop Israel from using Lebanese airspace and land to launch attacks into Syria. Such conversations have precedent. Clear parameters for both countries’ natural gas exploration were set in 2022 as a result of United States-mediated talks between Israel and Lebanon.

Amos Hochstein, the senior US energy advisor, arrived in Beirut on January 2024 to talk about ways to ease tensions between the two nations. Even though the overtures seem promising, the Lebanese people are aware of the dangerous circumstances that lie ahead.

To maintain Hezbollah’s legitimacy as the “resistance” to Israel, Nasrallah must balance keeping Lebanon out of conflicts that it cannot afford.

Why Lebanon is so fragile?

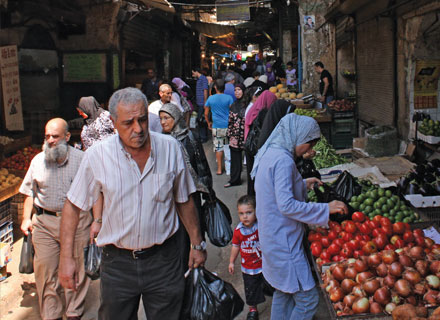

Lebanon is already on the verge of collapse due to several overlapping crises that have occurred over the past ten years. An estimated 1.5 million refugees have fled the civil war in neighbouring Syria to seek safety in Lebanon since 2011. The nation is home to the highest concentration of refugees worldwide, both per person and per square kilometre.

In addition, Lebanon has been dealing with a serious economic crisis since 2019, which got worse when the COVID-19 pandemic started. Because of this crisis, about 80% of Lebanese people currently live in poverty, with 36% falling below the extreme poverty line.

In 2020, this crisis got worse after the explosion at the Beirut port, which left 218 people dead and destroyed parts of the nation’s capital. Some 66% of Beirut’s private businesses were affected, up to $4.6 billion in material damage, and half of the city’s healthcare facilities were rendered inoperable by the explosion.

Want to know the extent of Lebanon’s precarious situation? The government has not passed a budget in more than ten years, Lebanon’s corruption index is 150 out of 180, and there have been verifiable reports of vote-buying and political meddling in elections. An estimated 2 million people protested in the streets in October 2019 to call for the resignation of the government as the economic collapse deepened.

As per the Arab Barometer surveys, merely 8% of the population has some sort of faith in the government, a substantial decrease from the other Middle Eastern nations. In Iraq, where the populace has the next lowest degree of faith in their government, a significantly higher percentage (26%) states they have a great deal or fairly a lot of faith in the government.

According to the December 2023 World Bank Lebanon Economic Monitor, the spillover effects from the Gaza conflict will severely affect Lebanon’s precarious growth model.

“Without the implementation of a comprehensive crisis resolution plan, no long-term investment is feasible, and the country’s physical, human, social, and natural capital will be further eroded,” the report stated further.

“By 2023, Lebanon’s economic growth was projected to expand, for the first time since 2018, by 0.2%. Tepid growth was predominantly caused by volatile drivers: a growth in consumption due to a strong summer tourism season; a sizable inflow of remittances; increasing dollarisation of salaries; and signs of stabilisation in private sector activity. With the onset of the current conflict and in the absence of broader economic stabilisation, Lebanon’s economy is now projected to be back in recession in 2023. Macroeconomic imbalances also persist, as the current account remains in a sizeable deficit of 12.8% of GDP,” the report noted.

The inflation rate in the West Asian nation has remained in the triple digits since 2021, driven by exchange rate depreciation and the rapid dollarisation of economic transactions. Furthermore, Lebanon topped the list of countries hardest hit by nominal food price inflation in the first quarter of 2023 (at 350% in April 2023). Sovereign debt, at 179.2% of GDP in 2022, remains unsustainable amid a sharp currency depreciation and economic contraction.

Charting the recovery path

Thirty years of reckless fiscal indiscipline have resulted in Lebanon’s currency losing over 95% of its value before the current crisis. The banking industry is in disarray, corruption is pervasive, and the currency is collapsing.

Rebirth Beirut’s Samar Hawa, a Lebanese NGO with a main mission to help Beirut and support Lebanon, observes, “Like a Phoenix rising from the ashes, so do the Lebanese people demonstrate their resiliency.”

A catastrophic depreciation of the Lebanese Pound, also called the Lebanese Lira, has left citizens like Samar struggling to maintain their life savings. As of October 17, 2019, even USD deposits suffered and were converted into what the locals called “Lollars,” a term that was first used by a Lebanese economist. This demonstrated the severe devaluation and harsh financial realities the nation faces by effectively meaning that, in terms of use, $100 in the bank would only be worth $10.

Due to bank runs, which left banks bankrupt, this scenario not only highlights the severe financial crisis but also provides a stark example of third-party risk. Lebanon still does not have a capital control law or efficient crisis management procedures, even after four years of unrest.

On the other hand, Bitcoin provides a transparent substitute thanks to its fundamental self-custody principles, which enable users to access their money without requiring authorisation from outside parties. A decentralised and secure financial system is ensured by its immutable and trustworthy consensus mechanism, which removes the vulnerabilities of a single point of failure and lowers the possibility of fraud. Its transparency reduces the risk of arbitrary policies that could devalue currency.

Frequently impacted by political changes, the Lebanese economy experienced a shock in 2019. Protests across the country were triggered by the government’s plan to increase taxes on necessities and services. Consequently, the banks closed, trapping deposits and preventing most people from accessing their savings—aside from a select group of highly influential individuals, primarily the bank owners and “Tier 1” politicians—from doing so.

Therefore, Bitcoin is more than just a financial asset in Lebanon’s struggle; it’s a representation of change, an example of the strength of innovation, and possibly the nation’s first move toward a future in which the currency will be as resilient as its citizens.

Also, the Central Bank has initiated limited but encouraging reforms, amid the relative stabilisation of the exchange rate. However, none of these will bear the desired fruits in the absence of fundamental changes to bank supervision and the conduct of monetary and exchange rate policies.

“The sizeable inflow of remittances, Lebanon’s longtime lifeline, has acted as a de-facto social safety net and supported modest growth in domestic consumption. However, remittances alone are not sufficient to meet external financing needs, and absent other financing sources, Lebanon’s twin deficits in the current and fiscal account may require a further drawdown in the Central Bank’s foreign currency reserves,” World Bank suggested further.